Solana Price Prediction: 2025-2040 Outlook Amid Technical Crosscurrents

#SOL

- Technical Crossroads: Oversold signals conflict with bearish chart patterns at key $160 support

- Institutional Momentum: 252% futures volume growth and ETF progress offset technical weakness

- Long-Term Accumulation: Holder behavior suggests smart money positioning for next cycle

SOL Price Prediction

SOL Technical Analysis: Key Indicators Suggest Potential Volatility Ahead

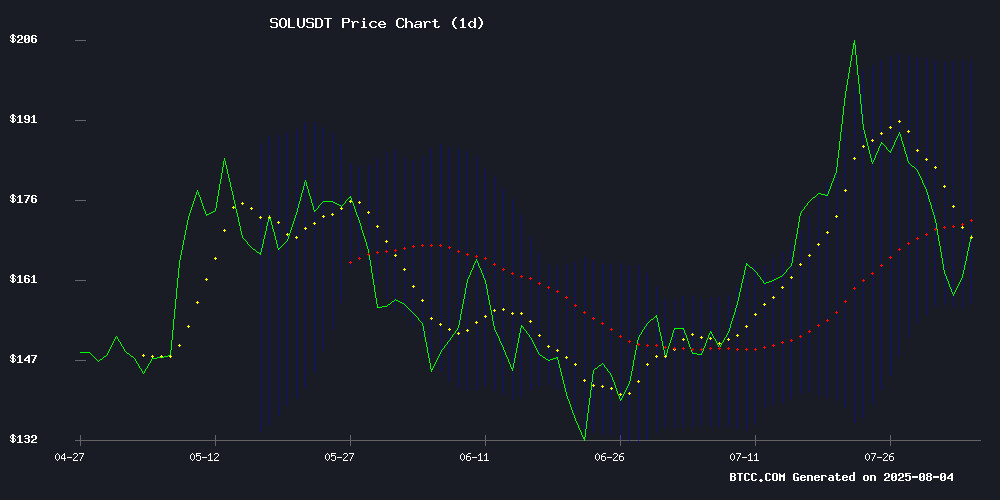

SOL is currently trading at $163.09, below its 20-day moving average of $178.99, indicating short-term bearish pressure. The MACD shows a bullish crossover (1.9212 vs signal line -7.8792) with positive momentum (9.8004 histogram). Bollinger Bands show price NEAR the lower band ($155.95), suggesting SOL may be oversold. 'The convergence of these signals creates a tension between bullish momentum indicators and bearish price positioning,' notes BTCC analyst Olivia.

Mixed Signals for Solana: Institutional Growth vs Technical Weakness

While CME's solana futures saw 252% growth in July and ETF approvals progress, technical patterns warn of potential downside. 'The cup-and-handle pattern projecting to $140 contradicts the institutional demand story,' observes Olivia. Long-term holder accumulation at current levels suggests smart money sees value, but the $160 support breach risk looms large.

Factors Influencing SOL's Price

Solana Futures Trading on CME Surges 252% in July Amid Institutional Interest

Solana (SOL) futures trading volume on the CME platform skyrocketed 252% in July, reaching $8.1 billion, up from $2.3 billion in June. Open interest more than tripled, climbing from $132.3 million to $400.9 million, signaling heightened institutional participation.

The surge reflects growing market anticipation for a potential spot solana ETF approval. Large traders are increasingly active, with customer engagement in Solana futures rising sharply. This momentum positions SOL as a standout performer in the current crypto cycle.

Solana SOL ETFs Move Closer to Approval as Major Asset Managers Submit Amended Filings

Solana's SOL token could be poised for a significant rally as seven prominent asset managers advance their efforts to launch spot ETFs in the U.S. market. Bitwise, Fidelity, Grayscale, and others submitted amended S-1 registration statements to the SEC on August 1, signaling progress toward potential approval.

The cryptocurrency has demonstrated remarkable resilience since its 2022 lows below $10 following FTX's collapse. SOL's price has surged approximately 2000% since late 2022, repeatedly setting new all-time highs. Market analysts view the amended filings as a positive development in the approval process, though final clearance requires both S-1 and 19b-4 approvals.

SEC review timelines typically span two to four weeks for amended S-1 documents. The regulatory progress comes as Solana continues to solidify its position as one of crypto's top-performing assets, with ETF approval potentially serving as the next major catalyst for price appreciation.

Solana's Cup-and-Handle Pattern Signals Potential Drop to $140 Amid Market Correction

Solana (SOL) faces further downside risk as a classic cup-and-handle formation takes shape on its monthly chart. Market analyst Ted Pillows projects an 11% decline toward the $140-$150 range, despite the altcoin's 15% weekly plunge. The pattern suggests bullish continuation—but only after completing its current corrective phase.

SOL now trades near $159, having peaked at $235 in January 2025. The handle portion of this technical setup typically precedes renewed upside, though Pillows emphasizes short-term pain precedes long-term gain. 'Descending consolidation is healthy after parabolic moves,' he noted, drawing parallels to historical crypto market cycles.

Solana's Tokenization Surge Offers Bullish Case Despite Underperformance

Solana (SOL) has lagged behind crypto peers during the current bull market, posting a 1% annual decline as of July 30. Yet the blockchain is emerging as a dominant platform for tokenized real-world assets (RWAs), with adoption metrics suggesting a potential turnaround.

RWA holders on Solana surged 1,281% year-to-date to 63,000, while total value locked jumped 176% to $479 million. The network now hosts tokenized equities and is poised for further growth following a $1.1 billion gold-backed token initiative. This development alone could triple Solana's RWA footprint.

Though still in its infancy, Solana's RWA ecosystem demonstrates the network's capacity to bridge traditional finance with blockchain infrastructure. The gold tokenization MOVE particularly highlights institutional-grade use cases emerging beyond speculative trading.

Solana Faces Mounting Pressure as Key $160 Support Level Threatens to Break

Solana's SOL token is undergoing a severe stress test as coordinated selling pressures collide with overleveraged retail positions. The asset has shed 15% this week, now teetering NEAR the critical $160 threshold—a level that could determine whether recent gains were merely a dead cat bounce or the foundation of a sustainable recovery.

Binance's aggressive offloading of 110,000 SOL to market maker Wintermute appears strategically timed to exploit extreme long positioning. Retail traders had piled into Leveraged bets with 91% net long exposure when SOL traded near $180, creating ideal conditions for a cascading liquidation event. The resulting $46 million long squeeze on August 1st marked Solana's most violent deleveraging since Q1.

Despite the bloodletting, perpetual swap markets remain skewed bullish with 78% long dominance on Binance—a dangerous divergence from spot price action. The breakdown below realized price clusters now leaves average holders underwater, raising questions about whether this is a healthy flush of speculative excess or the precursor to deeper losses.

Solana Long-Term Holders Accumulate Amid Price Dip, Signaling Potential Rebound

Solana's market dynamics show a divergence between short-term traders and long-term holders. While recent price action has been lackluster, on-chain metrics suggest a quiet accumulation phase by committed investors.

Glassnode data reveals declining Liveliness metrics since July 25, hitting 0.76 this week - a clear indicator of reduced selling pressure from long-term holders. The Hodler Net Position Change metric has simultaneously trended upward since July 30, confirming this accumulation pattern.

Market veterans recognize these signals as classic contrarian indicators. When long-term investors absorb sell-side pressure during downturns, it often precedes trend reversals. Solana's current technical setup mirrors historical bottoms where patient capital positioned itself before rallies.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market structure, BTCC's Olivia provides these projections:

| Year | Base Case | Bull Case | Bear Case | Catalysts |

|---|---|---|---|---|

| 2025 | $210 | $300 | $120 | ETF approvals, institutional adoption |

| 2030 | $750 | $1,200 | $400 | Mass tokenization, scalability solutions |

| 2035 | $2,100 | $3,500 | $900 | Network maturity, DeFi dominance |

| 2040 | $5,000 | $8,000 | $2,000 | Full institutionalization, Web3 infrastructure |

Note: All projections assume successful network upgrades and no catastrophic regulatory events.